Unlock Big Tax Savings with Ram Trucks at Enumclaw CDJR

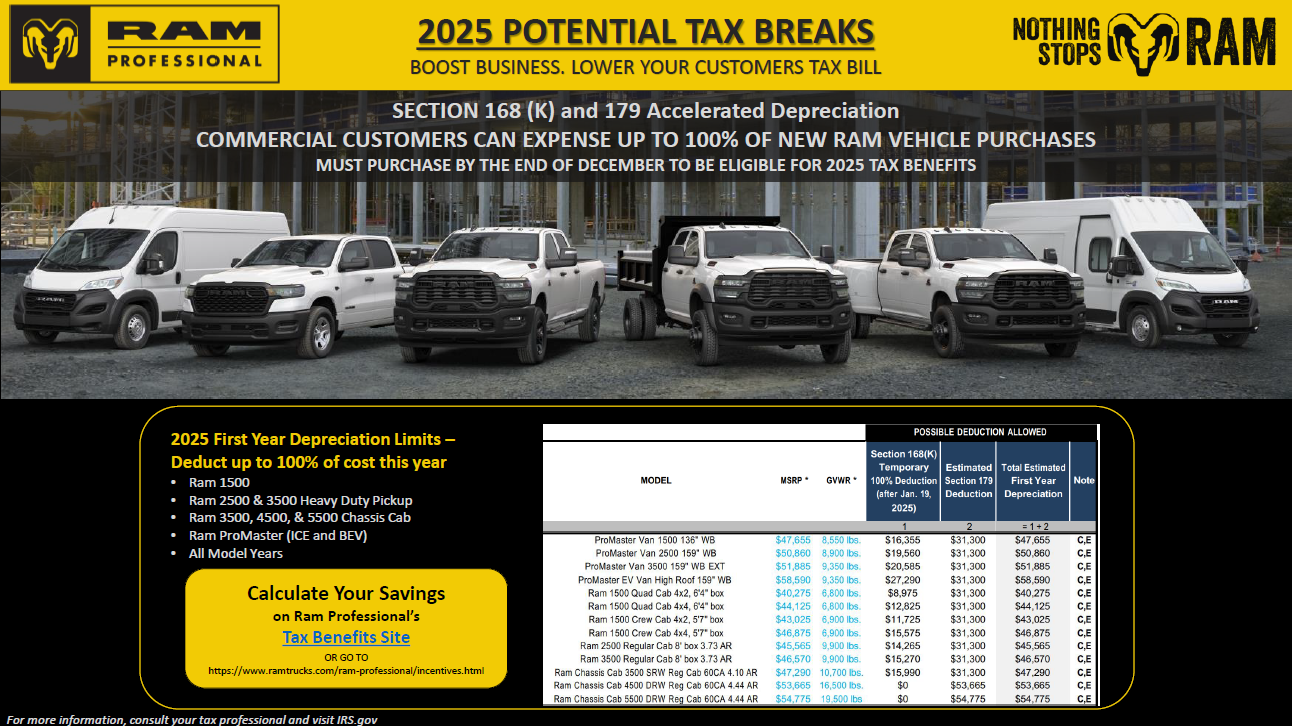

Attention business owners! Did you know that you could deduct up to 100% of the cost of a new Ram truck purchased in 2025? Thanks to Section 168(k) and Section 179 Accelerated Depreciation, businesses have the opportunity to reduce their tax bill by expensing the full purchase price of eligible vehicles—this year!

Eligible Vehicles for up to 100% Deduction:

- Ram 1500

- Ram 2500 & 3500 Heavy Duty Pickup

- Ram 3500, 4500, & 5500 Chassis Cab

- Ram ProMaster (ICE & BEV)

Key Details:

- Must purchase by December 31st to take advantage of 2025’s tax benefits.

- Available for all model years of these vehicles.

Why Choose Ram at Enumclaw CDJR?

Whether you're looking for a powerful truck like the Ram 1500 or need heavy-duty power with the Ram 3500 or Ram ProMaster, Enumclaw CDJR has the perfect option for your business. And with these incredible tax benefits, it's a great time to invest in a new vehicle that works as hard as you do.

Calculate Your Savings:

Head over to the Ram Professional Tax Benefits Site to calculate your savings today.

Act Fast!

Don’t wait! To qualify for these benefits, make your purchase by the end of December 2025.

Consult Your Tax Professional

For full details, consult your tax professional and visit the IRS at IRS.gov.

Frequently Asked Questions (FAQ)

Section 168(k) (also called “bonus depreciation”) allows businesses to immediately deduct a large percentage — up to 100% — of the cost of qualifying business property (like Ram Professional trucks and vans) in the year they place the vehicle into service, instead of spreading the deduction out over several years. This can boost your tax savings significantly in the first year.

Section 179 lets businesses deduct the full purchase price of qualifying equipment (including eligible commercial vehicles) in the year the vehicle is bought and used for business. Essentially, it lets you treat a large portion — or even all — of the cost as a business expense right away instead of depreciating the vehicle over time.

Both Section 168(k) and Section 179 provide accelerated tax deductions, but they work differently:

- Section 179 has a deduction limit and may be limited by your business income — you can’t deduct more than your taxable business income for the year.

- Section 168(k) bonus depreciation doesn’t have a business income limit — and when the rate is at 100%, you could take the full deduction even if you claim the maximum Section 179 first.